Having your Google Ads account suddenly suspended can send shivers down any marketer's spine. But receiving the dreaded “suspicious payments” violation notice takes that gut punch to the next level. Your ads have been completely paused without warning, the fate of your account hangs entirely in doubt, and vague accusations of potential payment fraud now threaten your reputation and livelihood. Few nightmares compare to staring down an abrupt Google Ads suspension for suspicious payments activity. So what exactly does this violation mean? What triggering actions may have Google believing you attempted advertising fraud? And most critically—what immediate steps should you take next to appeal this suspension and regain desperately needed account access? I’ll walk you through everything you need to know.

Understanding Google Ads Account suspended suspicious payments issue

If that foreboding message about suspicious payments activity pops up when you access your Google Ads account, the very viability of your campaigns has been thrown into peril. This ominous violation notice essentially means Google’s automated systems detected questionable characteristics around recent payments tied to your advertising activity.

As a result, they’ve taken severe but cautious action by entirely suspending your account and halting all ads until the concerns raised can be properly investigated. You now face a tremendous uphill battle to clarify the payment situation and comply with policies before the opportunity for account reinstatement expires.

Reasons for Suspicious Payments in Google Ads

When that alarming “suspicious payments” violation surfaces, your mind races wondering what possibly could have triggered such severe accusations. Google’s systems flagged some aspects of recent transactions as seriously questionable. But what specifically?

There are a wide range of scenarios that could have signaled red flags:

Shared Payment Sources With Other Suspended Accounts

One of the most common reasons for an innocent account getting caught up in a suspicious payments violation is having a payment method linked to other accounts currently serving suspensions.

For example, if you use the same credit card across multiple customer accounts, and one of those accounts gets banned for unrelated policy violations, your own account is now at risk solely by association. Google’s system automatically flags all shared payment sources across linked accounts.

So even if you have done nothing wrong yourself, having financial ties and payment crossover with suspended accounts often triggers this violation notice to appear preemptively.

Mismatched Account Holder Names

Google understandably expects the name listed on any payment method to match the registered account holder name entered during setup. So if you input a company credit card under the CEO’s name, but your personal Google account credentials differ, this discrepancy can also trigger suspicious flagging.

Billing Address Conflicts

Similar to mismatched names, variations between the billing address tied to your payment details versus your account address also commonly cause problems.

When registering Google Ads manager accounts officially under a business domain, you must input the formal company office address where all related billing statements route. Using personal home addresses instead with company credit cards risks rejections.

Sudden Changes in Payment Amounts

If your account typically maintains steady, predictable monthly spend, then all of a sudden experiences a dramatic spike in payment volume, Google may interpret this abnormality as potential fraud.

Say you launch a seasonal promotion driving way more traffic, or you test some risky new tactics scaling spend faster than normal. These drastic fluctuations appear suspiciously out of character, prompting violation notifications.

Payment Declines and Unpaid Invoices

Missed payments whether due to insufficient account balances, expired payment methods, or intentional delinquency also commonly trigger suspensions. Google understandably halts all advertising immediately whenever they cannot successfully process payments owed.

Before escalating to full account suspensions though, you typically receive unpaid balance notifications first. So surprises are preventable if you proactively resolve declines and refresh payment details.

Google’s advertising systems process incredible transaction volumes daily. To maintain integrity and prevent rampant fraud at scale, their detection systems mustremain hyper vigilant. The slightest anomalies can activate automated safeguards like suspension systems.

But not all “suspicious payments” violations stem from advertisers’ intentionally deceitful actions. Misconfigurations, shared data associations, billing discrepancies, and innocent activity changes also commonly trigger this disruption.

Understanding exactly what likely flagged your situation empowers you to gather the right evidence clarifying events as you work urgently to appeal the violation. Peel back payment layers to uncover what specific pieces tripped initial alarms.

How to Fix Google Ads Account Suspended Suspicious Payments

How to Get Your Suspended Google Ads Account Reactivated After “Suspicious Payments”

Discover exactly what to do step-by-step if your critical Google Ads access gets abruptly cut off because of a dreaded “suspicious payments” violation.

Let’s face it – having your Google Ads account suddenly suspended strikes fear and panic unlike much else. Those precious ads driving revenue growth have been completely paused without warning.

Even worse – vague “suspicious payments” accusations create confusion and reputation damage. You likely have limited time to clarify what triggered this violation and convince Google to reopen account access before you miss out on peak seasons or critical launches entirely.

So what specifically should you do to fix accounts suspended for suspicious payments activity detected? Follow this strategic blueprint to get back up and running ASAP.

Step 1: Verify No Actual Suspicious Activity Occurred

First, thoroughly audit recent payments and transaction to confirm your innocence. Scan bank statements and payment provider records using search terms for:

- Google Ads

- Suspicious transactions

- Recent declines

Verify no fraudulent charges exist that you didn’t authorize or recognize. Provide Google timestamped documentation proving all Google Ads payments align with expectations.

Proactively explaining clean records helps avoid further delays or complications as they review your suspension appeal.

Step 2: Identify What Triggered “Suspicious Payments” Flagging

If no unauthorized activity occurred, inspect account details closer to determine what specifically triggered violation systems.

Common culprits include:

- Shared payment sources with other accounts

- Mismatched names on accounts vs payment methods

- Sudden spikes in spending

- Billing address conflicts

- Unpaid invoices

Understanding the exact technical cause strengthens your correction plan specifics.

Step 3: Update Any Outdated Account Information

Double check all usernames, addresses, and payment details remain perfectly sync’d across profiles. Mismatches often confuse automated fraud detectors even if information is legitimate when explained.

For example, fix:

- Variations in legal business names vs. official credit card names

- Employee home addresses still listed instead of office billing address

Step 4: Add New Valid Payment Sources

To reestablish financial legitimacy, add brand new payment methods unaffected by previous rejection scenarios – new credit cards, prepaid balances, updated bank accounts, mobile wallet platforms etc.

The more alternatives provided, the less reliance stays tied to those original “suspicious” sources.

Step 5: Craft a Transparent, Compliant Appeal

Directly respond to the Google support suspension notification by submitting a formal appeal request. Adhere precisely to their required appeal template format. Explain in detail:

- What specifically triggered this (multiple accounts on shared payments, billing mismatches etc.)

- What you’ve proactively fixed (updates, new payment additions etc.)

- How you intend to prevent issues going forward

Avoid vague hype or excuses. Stick to facts demonstrating willingness to comply moving forward. Provide concrete evidence like payment records and account screenshot visuals wherever applicable.

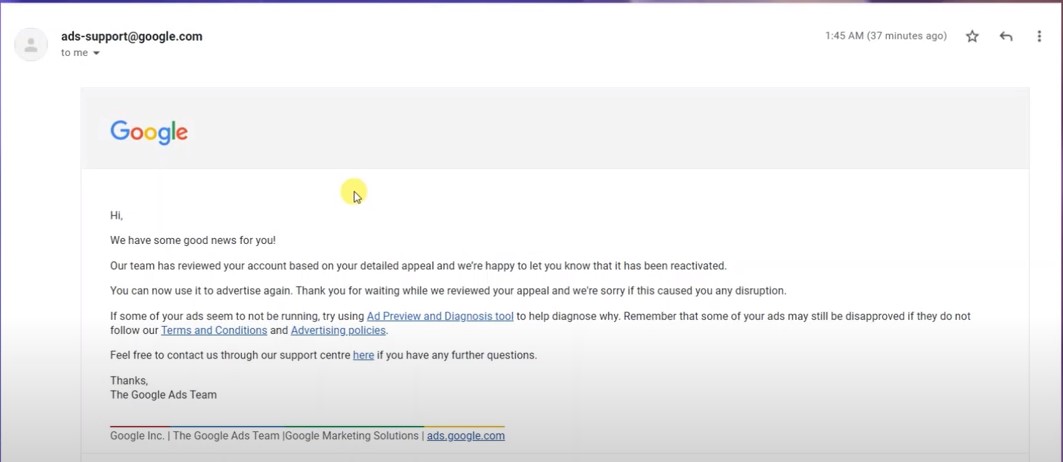

Step 6: Patiently Wait for Review

Understand that Google receives enormous appeal volume and very backlogged queues. The review process can take days or even weeks in complex cases.

Avoid harassing reviewers to “check status” every few hours. But do politely follow up if 1-2 weeks pass without any admin response. Renew questions explaining how time sensitive account access remains for your business continuity.

Step 7: Consider Additional Options If Needed

In rarer cases, appeal rejections still result even presenting air tight cases with all details explained and corrected.

Should your reactivation request ultimately get denied, a few last ditch efforts potentially remain:

- Appeal the appeal rejection decision with supplemental clarification

- Submit account deletion requests then attempt creation anew

- Seek guidance from legal counsel familiar with Google’s practices

But avoid opening “shadow” accounts hoping to sneak around suspensions, as Google quickly links new accounts through digital footprints and also bans these for attempting to circumvent enforcement.

Read more: Don't let Google Ads drop you! Fix Destination Mismatch NOW and save your campaigns.

Preventing Future “Suspicious Payments” Google Ads Violations

Getting your account abruptly suspended is frustrating enough. But you certainly want to avoid repeating that nightmare again in the future if possible. To optimize Google Ads account security and minimize causes of suspicious payments violations going forward, implement these proactive precautions:

Tighten Login Protections

Enable two-factor authentication using mobile apps like Google Authenticator for all manager and user logins. This adds an extra verification layer ensuring only authorized devices and individuals access your accounts with time-sensitive rotating codes.

Additionally, institute automatic password update notifications prompting periodic rotation every 60-90 days. Constantly refreshed access credentials limit unauthorized access opportunities.

Audit Roles and Permissions

Carefully examine what level of account and campaign controls you’ve granted to all manager users. Consider downgrading some teams to “viewer only” access without abilities to alter billing settings or payment instruments. Segment who can spend vs. who simply analyzes data.

Build Payment Alerts

Take advantage of account notifications offered by both Google Ads and your individual payment providers. Set up real-time texts or email alerts for payment declines, campaign budget pace acceleration, billing mismatches, and other monitoring criteria tailored to your typical account activity.

The faster you get warned of potential issues, the quicker you can investigate and resolve problems before suspensions occur.

Maintain Clean Contact Info

However tedious, routinely double check all names, addresses, phone numbers, and emails stay correctly synced across your Google profile, manager account, campaigns, billing and payments sources, and public business listings. Any slight mismatches can trigger automated fraud defender pauses.

Institute Monthly Reviews

Schedule recurring calendar appointments to perform monthly health checks reviewing campaign analytics, payment ledgers, policy change alerts, and account access logs. Consistent vigilance helps you notice cracks early and strengthen defenses.

Stay Adaptable

Finally, understand Google evolves rapidly. New feature announcements occur daily while policies see frequent revisions. Maintain awareness of changes, refresh knowledge through courses, and test innovations cautiously before deploying globally. What worked yesterday may break tomorrow amidst Google’s nonstop iterations.

Having your revenue-driving Google Ads account abruptly suspended due to “suspicious payments” can severely disrupt business operations and marketing initiatives. But with rapid response investigating specifics, updating information, communicating transparently, and committing to ongoing account security, many advertisers do successfully regain access after initially receiving this jarring violation. Stay vigilant preventing future issues by tightening account controls, maintaining clean payment sources, automating alerts, and consistently reviewing changes. With some last-ditch legal appeal support if necessary, suspended accounts from Google Ads suspicious payments actions can regain hope. Just remain determined through properly directed efforts.

Mohamed Fouad is a full-stack web developer and an entrepreneur who's really into advertising. He is the CEO of Rent Ads Agency, a company that helps businesses reach more customers through advertising. He graduated from Stanford University in 2018 and has over 4 years of experience in the tech industry.